Have you ever worried about putting information on your website and social media?

You might have held back from sharing advice in case you find yourself in trouble?

Or perhaps you’ve wanted to share a strong opinion but worried about the potential backlash?

It can feel like a lot to consider but having insurance for your blog could help get you out of a tricky legal situation.

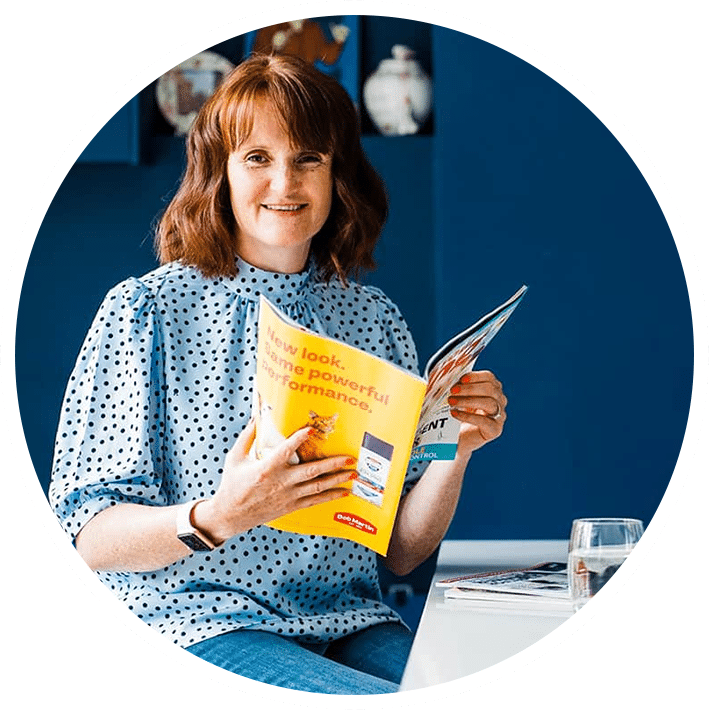

In this episode I’m speaking to Catherine France who provides a no nonsense approach to insurance, giving those who seek her help information, knowledge and confidence.

Catherine has 20 years’ insurance industry experience working within high profile businesses sharing information online.

She has a passion for using her experience to guide small businesses and empower them into understanding insurance so they can focus on running their businesses.

Catherine shares down to earth advice, and we reflect on cases where people didn’t have insurance to show the worst case scenario and to help make sure that doesn’t happen to you!

Plus helpful tips to make sure you’re covered.

If your mind gets foggy as soon as insurance is mentioned and you’re not sure whether you should be insuring your online content then this episode is for you.

You can listen in on the player link below or continue reading as a blog post.

Do you need insurance as a blogger?

Whilst insurance might not be the most exciting thing on your to-do list it’s definitely something we need to consider.

Once we put information of any kind on the internet and this includes social media, we are responsible for it.

Catherine explains: “The minute you hit publish, whether it’s your own or someone else’s material, and your contents on the internet then that becomes subject to UK law.

“And that can mean that you could potentially be infringing copyright, you could be accused of libel or defamation.

“So there’s a chance that potentially thing could go wrong.”

What sort of problems can arise?

Whether you’re blogging, tweeting, writing a post for Facebook or other social media sites you could be liable for legal action.

Catherine explained: “One key issue is defamation which is where you say something that could damage another person’s image or reputation.

“For example if you criticise another dog trainer’s methods they may lose business and they could make a claim against you.

“Then there’s copyright infringement, which can easily be done by accident.

“This is where you include information you don’t have permission to use so it may be protected by our complicated copyright law.

“The third key issue is confidential information, which could be done accidentally.

“This could be releasing information about a new product or company results without permission which leaves you at risk.”

It happens to real people

About five years ago I knew a lady who ran a beauty pageant and another lady made remarks on social media about her on Facebook.

The claim ended up being huge and she won a very substantial amount of money from the case due to the damages from a Facebook post.

It also happened in 2012 to Sally Bercow, the Speaker’s wife, who posted ‘Why is Lord McAlpine trending’ with the innocent emoji face.

The tweet was found to be defamatory, ironically because of the emoji, so she was in hot water for this.

Catherine explained what small business owners can do to prevent something similar from happening.

She said: “The three things I would consider when posting are, one, don’t publish anything that you wouldn’t want to see on the front of a national newspaper. It’s that simple.

“The second is that when using sources, fact check with them first before posting any statements.

“Finally, never post in anger. You might type something out but leave it in your drafts and walk away to come back to it when you’ve calmed down.”

Don’t panic and think you need to stop publishing

While there are high profile cases of defamation and other legal action about content online, Catherine isn’t trying to scare us!

She explained: “As small businesses if we upset someone, I think if an apology was issued and it was taken down then it wouldn’t end up on the front page of a newspaper.

“But it’s important to remember that there are different scales to the seriousness of these things.”

What policy pet businesses should consider to be protected

Catherine explained what policies to look for to make sure you’re protected should anything go wrong.

She said: “Defamation, copyright infringement, libel and all those types of things that we’ve talked about, would come under your professional indemnity policy.

“This would provide you with the protection if you were to make a mistake in the line of your work.

“Those mistakes would have to result in somebody losing out financially. Public liability insurance is damage or loss that you caused to a third party.

“So if I spilled coffee over your laptop, you make a claim on my policy, we’d replace your laptop.

“But professional indemnity covers that financial loss that could be made as a result of a mistake that you make.

“So that’s where you’d be looking for; cover that would extend to the things that you publish, and any accusations of fault that you might get as a result of that.

“If you’ve already got a professional indemnity insurance policy, part of that cover that they’re providing you with should be for the things that we’ve talked about.

“You can even now go online and buy blogger insurance and media liability insurance.”

This doesn’t mean you have to suddenly buy new insurance, if you’re about to renew yours you can always give them a call and check if it covers you.

Catherine added: “You can do a lot of things online but as we do so many things with our small business it’s important to give them a call and explain all the different activities that we do within the business so that the insurance covers you.”

Steps you can take to protect your blog

Blogging is great for our businesses and there are things you can put in place on your blog to help to protect you.

Catherine explains: “On your website, make sure you have Terms of Use.

“You can include disclaimers on your blog posts that say ‘this doesn’t constitute advice, it’s information. If you need anything in more detail, then either contact me directly.’

“Or as a pet professional, you might suggest they seek veterinary advice.”

What if you get a claim made against you?

Claims can and do happen, which is where having insurance comes in to help.

Catherine said: “In the case of a claim, contact your insurer, they will give you a helpline number and they will put you in touch with experts to ensure you have the right advice.

“They will guide you step by step through the process.”

Where to get more information and advice

Catherine is offering listeners of the podcasts a reduced rate 30 minute zoom call with her so that you can make sure you’re getting your cover from the right place.

She’ll give you a written summary of the conversation and you can have a recording and the aim of the call is to help you to feel more confident.

This service is usually priced at £39 but Catherine is offering it to listeners / readers for £35.

Catherine also talks more about insurance on her website.

She covers a range of different topics and debunks the jargon so that you can understand what you might need, how you might get it and the costs that could occur.

Visit Catherine’s website: www.catherinefrance.com

Follow her Instagram at www.instagram.com/catherinefranceuk/

If you found this post helpful, you might like to read How to Get Your Pet Business Found on Google with Rosie Robinson and if you’re interested in learning how to get started with blogging, you can join the Get Found On Google course starting June 7th 2021. Find out more here.